Seema had been a meritorious student throughout school. Since childhood, she had dreamt of becoming a doctor. After completing her schooling, she wanted to pursue graduation abroad. She even got admission to the Stanford University School of Medicine, USA. The only thing standing between her and her dream was a shortage of funds. Apart from the huge tuition fees, there were several other expenses. But her father’s savings were stretched thin. Did Seema fulfil her dream and attend the medical college abroad?

Yes, she did. How? It was with a personal loan that her father took for her higher education.

Yes, Seema’s wishes were fulfilled. But what about yours? Here is a short guide to help you take a decision if you are in a similar situation.

Personal Loan for Higher Education Abroad

A personal loan is a flexible loan. It can be put to myriad uses without any restrictions. Do you want to finance a family vacation, a medical exigency, a business need, or higher education abroad? A personal loan can come to your rescue in all these situations. Because of its benefits, a personal loan is a useful source of finance for higher education abroad. Let us see what the benefits of a personal loan for higher education are:

- Ease of Availability

Personal loans are easily available. You get quick approval for them. Thus, students or their parents can arrange the finances within a short period.

- Collateral-Free Loans

Personal loans do not need any security pledged against its value. Thus, personal loans are a blessing for individuals who have no assets to pledge as collateral.

- Competitive Interest Rates

The interest rate of personal loans starts from 11.99% per annum, which is not too expensive. Borrowers with good credit scores can get personal loans at such low rates of interest.

- Loan Features

The maximum loan limit can go up to Rs 25 lakh. That is enough to finance higher education abroad. Moreover, the repayment tenure is also flexible. It goes up to five years. Thus, the loan is flexible enough to fund your education.

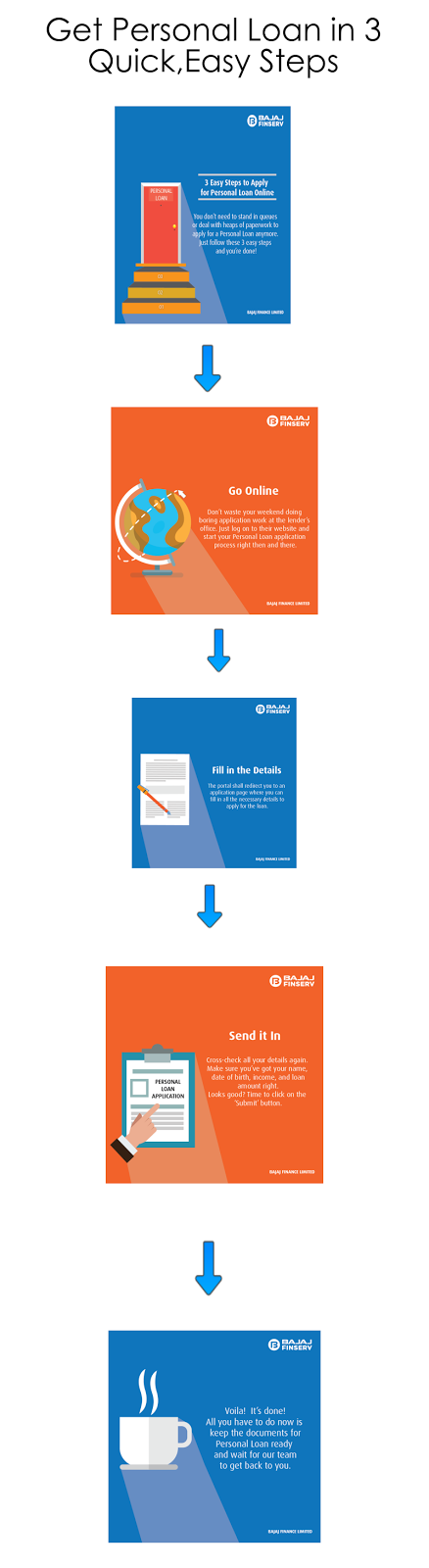

How to Apply for a Personal Loan

Getting a personal loan is easy. For those who want a detailed outline of the process, here is the lowdown:

- Check Eligibility: Do not go running to any bank or financial institution to apply for a loan. Use the internet and let your research do the talking. The first step is to check eligibility. Provide your details and check your eligibility online using the eligibility calculator.

- Apply Online: Once you meet the basic eligibility standards, the next step is to apply for the loan. You can apply online for it.

- Submit the Documents: The last step is to submit your documents. The documents required are specified. The borrower can get the loan after submitting them.

So, a personal loan can meet various needs. One of those is to fund higher education. If you need a personal loan for higher education, you can easily apply online and enjoy the benefits.

0

0