Taxation (Direct tax and Indirect tax), Income Tax, Corporate Tax

BBA , B.COM, PGDM examination by Universities, Colleges or autonomous institute or others.

Topics Covered

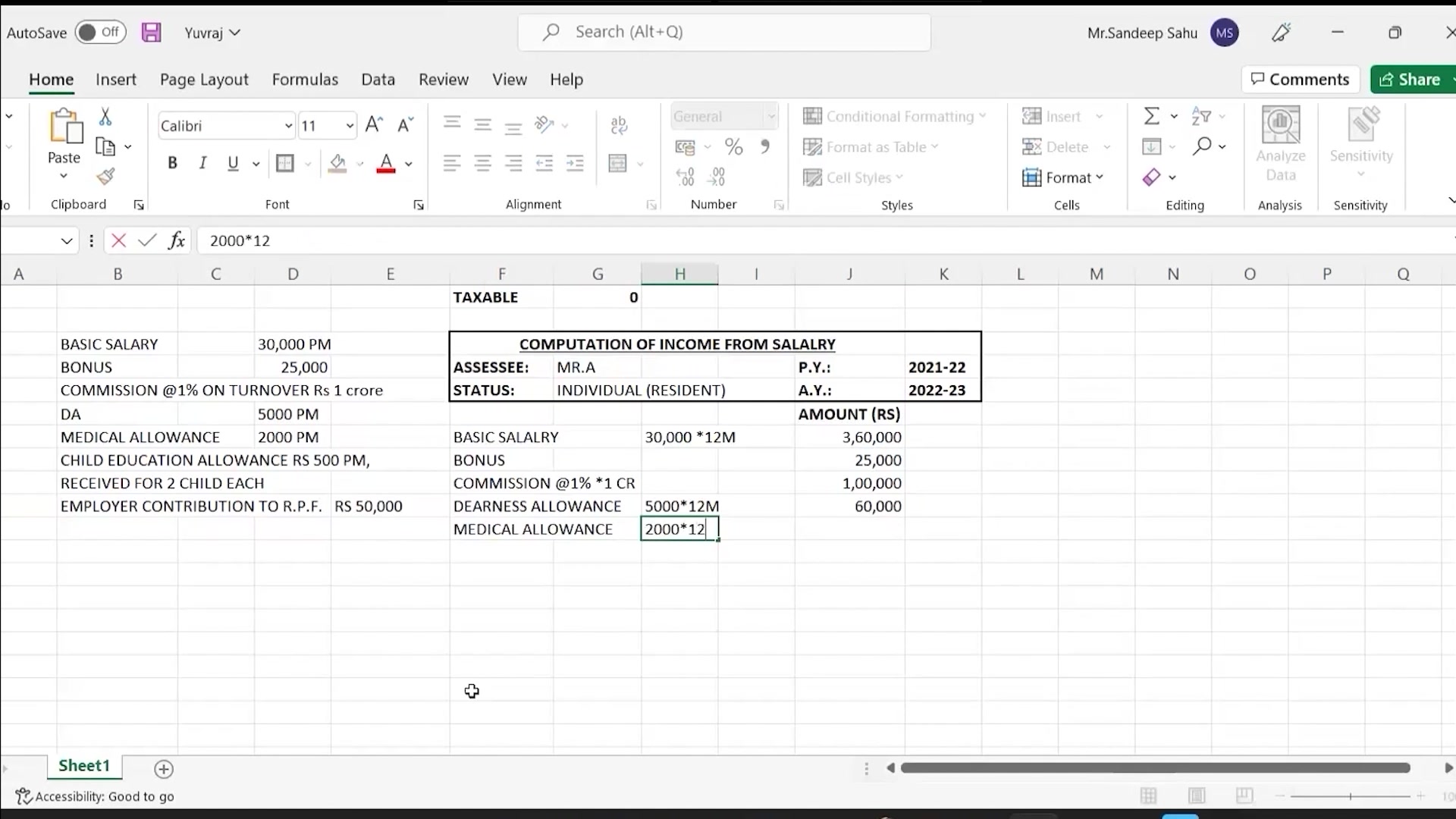

Part I: Income-tax (50 marks) 1. Important definitions in the Income-tax Act, 1961 2. Basis of charge; rates of taxes applicable for different types of assessees 3. Concepts of previous year and assessment year 4. Residential status and scope of total income; Income deemed to be received / deemed to accrue or arise in India 5. Incomes which do not form part of total income 6. Heads of income and the provisions governing computation of income under different heads 7. Income of other persons included in assessee’s total income 8. Aggregation of income; set-off or carry forward and set-off of losses 9. Deductions from gross total income 10. Computation of total income and tax payable; rebates and reliefs 11. Provisions concerning advance tax and tax deducted at source 12. Provisions for filing of return of income. Part II: Indirect Taxes (50 marks) Objective: To develop an understanding of the basic concepts of the different types of indirect taxes and to acquire the ability to analyse the significant provisions of service tax. 1. Introduction to excise duty, customs duty, central sales tax and VAT – Constitutional aspects, Basic concepts relating to levy, taxable event and related provisions 2. Significant provisions of service tax (i) Constitutional Aspects (ii) Basic Concepts and General Principles (iii) Charge of service tax including negative list of services (iv) Point of taxation of services (v) Exemptions and Abatements (vi) Valuation of taxable services (vii) Invoicing for taxable services (viii) Payment of service tax (ix) Registration (x) Furnishing of returns (xi) CENVAT Credit [Rule 1 -9 of CENVAT Credit Rules, 2004]

Who should attend

CA IPCC students, CS Executive students , CWA Inter students PGDM students, BBA students, BCOM/ MCOM students

Pre-requisites

Get earlier registration, Registration fee 500/-

What you need to Collect

Study material or notes, provided at our hand.

Key Takeaways

Gain expert knowledge in the field of taxation.