Options Trading Mastery Course

Why to joint:

To get practical Knowledge and implication of risky instrument asset class like option and to generate monthly revenue without headache.

Who will Tech you?

Vinay vasudeo sir-Derivative Market Expert

28 years plus experience in the stock market operation since 1994.

Senior Manager at Sykes & Ray Equities (India) Ltd.

Derivative market making in year 2000

Hedge fund manager In C R Kothari and Sons.

CEO of Aakashaya Patra Education And Research Wings.

What you'll learn

- Master the basic nuts and bolts of Options trading

- Understand the theory and mathematics behind Options

- What are the factors that affect Options pricing

- Quantitative Concept –Mean Reversal, Volatility

- India VIX role in option trading.

- Option Greeks: Delta, Theta, Vega, Gamma and its impact on option pricing

- Multiple Option type

- Choice of expiry series and ITM, ATM and OTM Options when looking at Pay off in option

- Option Chain Analysis

- Call Put Ratio And Open Interest

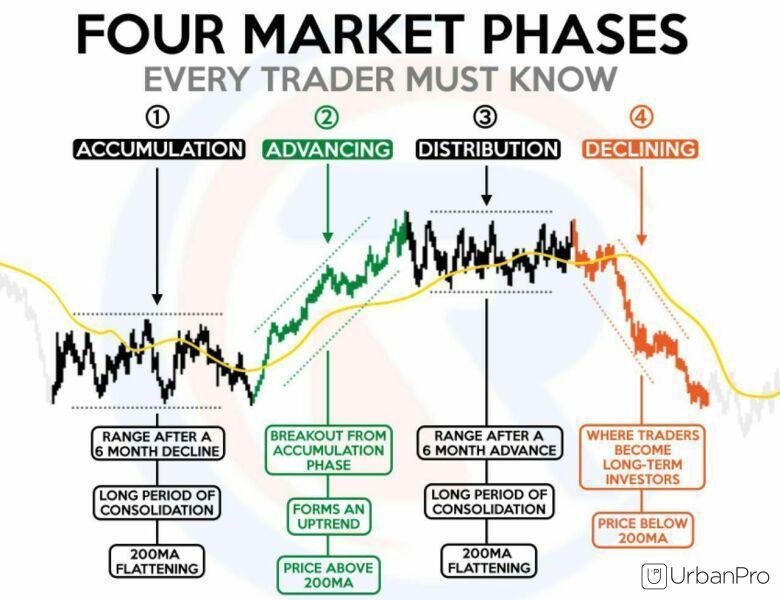

- Various Option Strategies and how to implement best strategies in the different market Type.

- Risk Management, Position Management, Trade Management, Money Management

- Live Market Practical Training.